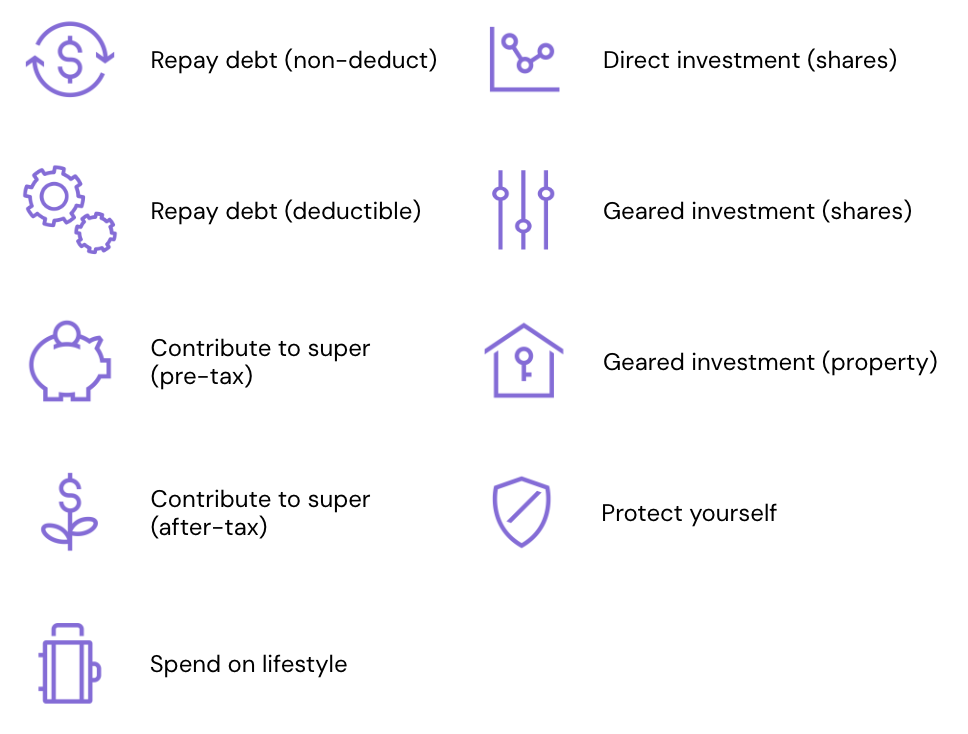

The 9 things you can do with your money.

Managing your money can feel confusing and confronting at times, with conflicting advice, myriad financial strategies and endless options. So you might be surprised to learn that in reality, there are actually only nine things you can do with your money.

In this article, we break down these nine key strategies and help you take your finance game from chaos to confidence.

There are (only) 9 things you can do with your money.

When you break it down to its simplest form, there are really only nine things you can do with your money.

1. Repay Non-Deductible Debt

Non-deductible debt includes debts like home loans and credit card facilities. Paying off this kind of debt can reduce your financial burden and free up cash flow.

2. Repay Deductible Debt

Deductible debt refers to debt held against investments. While it might seem wise to pay down deductible debt, it can actually be a fairly low-return exercise. That’s because the interest you pay on this debt can often be deducted from your taxable income.

3. Make Pre-Tax Contributions to Super

You can also make pre-tax contributions (also known as concessional contributions) directly into your super account. You do this either by asking your employer to pay some of your pre-tax salary directly into your super account (known as salary sacrifice) or by making a personal deductible super contribution.

These contributions are taxed at 15%, which is typically well below most people’s marginal tax rates. And this means pre-tax contributions can be a great tax-saving strategy.

However, superannuation is also subject to access restrictions, so it’s not always suitable at every life stage. Additionally, it’s worth remembering that annual contributions to super are capped, and exceeding these caps can result in hefty penalties. So you should check with your financial adviser before contributing.

4. Make After-Tax Contributions to Super

After-Tax Contributions (also known as non-concessional contributions) occur when you contribute to your super from your savings or your take-home pay – that is, money that has already been taxed, and for which no tax deduction is claimed. That’s all to say, making this type of contribution isn’t taxed (unless you exceed the contribution cap*) and future earnings on your investments will be taxed at only 15%, up to the cap amount, and not your marginal tax rate.

* Remember annual contributions to super are capped, and exceeding these caps can result in hefty penalties. Speak to your financial adviser before contributing.

5. Invest in Cash or Shares

You can also place your money into savings accounts, term deposits, or buy shares. This is a pretty straightforward approach to growing your wealth.

6. Gear into Shares

This involves borrowing money (taking out a loan) to invest in shares. This strategy allows you to accelerate the growth of your share portfolio and use your surplus cash flow to pay the interest on your loan, which is also generally tax deductible.

7. Gear into Property

Similar to gearing into shares, this strategy involves borrowing money to purchase an investment property. This strategy can be a powerful way to build wealth and inter-generational access to real estate.

8. Protect Yourself

Most people don’t give a moment’s thought to insuring their home, their car or other major assets. But in actual fact, your ability to generate an income is your biggest asset of all. So ensuring you and your family are well protected is central to any solid financial strategy. Getting life insurance, total permanent disability (TPD), trauma insurance, and income protection in place is one of the most important financial decisions to make. And a word to the wise – it’s often much easier to get these insurances in place whilst you’re young, fit and healthy.

9. Spend on Lifestyle

Last but certainly not least: you can choose to spend more on your lifestyle. While it’s important to save and invest, there are no certainties in this life. So it’s equally important to enjoy this – your one life – today. So we’d argue that any good financial strategy begins with your hopes, dreams and aspirations. And that includes big decisions about how you’ll enjoy the fruits of your labour.

Summing up: the nine things you can do with your money.

Finance can feel daunting at times. But fear not! When it comes to decisions about your dollars, the path forward becomes much clearer when you realise there are only nine key strategies at play.

From debt management to investments, and from super strategies to ensuring you’re well protected, the choices boil down to just nine distinct options (and not 9 million, as many people would have you believe).

Generally speaking, most people undertake a number of these strategies over the course of their lifetime. The trick is working out which ones are right for you, at which time.

And it’s worth noting that any financial strategy – even keeping money under your mattress – comes with its own benefits and risks. Understanding your ability to fund debt or investment programs, manage cash flow and weather market volatility is essential to building a healthy long-term strategy. But with some good financial advice, and a clear understanding of the nine things you can do with your money, you’ll find that financial success is well within reach.

If you are interested in exploring these options further, our team is here and ready to help.

Ready to get strategic?

Our Private Wealth team is here to provide personalised guidance and tailored advice, helping you navigate all of these strategies with confidence.

Learn More